Max 401k 2025 - This year the irs announced there will be an increase to the maximum employee 401 (k) contribution limit for 2025, increasing it to $23,000, a $500 increase. What is max 401k contribution 2025 over 50 minda sybilla, for 2025, the 401 (k) contribution limit for employees is $23,000, or $30,500 if you are age 50 or older. Annual 401k Contribution 2025 gnni harmony, Here are a few reasons this rmd change to roth 401(k)s could be a big deal: The 401(k) contribution limit for 2025 is $23,000.

This year the irs announced there will be an increase to the maximum employee 401 (k) contribution limit for 2025, increasing it to $23,000, a $500 increase. What is max 401k contribution 2025 over 50 minda sybilla, for 2025, the 401 (k) contribution limit for employees is $23,000, or $30,500 if you are age 50 or older.

Maximum 401k Contribution 2025 Calculator Sela Wynnie, What is max 401k contribution 2025 over 50 minda sybilla, for 2025, the 401 (k) contribution limit for employees is $23,000, or $30,500 if you are age 50 or older. The 401 (k) contribution limits for 2025 are $23,000 for people under 50, and $30,500 for those 50 and older.

Max 401k Contribution 2025 Mega Backdoor Karly Martica, What is max 401k contribution 2025 over 50 minda sybilla, for 2025, the 401 (k) contribution limit for employees is $23,000, or $30,500 if you are age 50 or older. Starting in 2025, employees can contribute up to $23,000 into their 401(k), 403(b), most 457 plans or the thrift savings plan for federal employees, the irs announced nov.

What are the new solo 401k contribution limits for 2025?

Irs Limits 401k 2025 Rene Vallie, The contribution limit for 401 (k)s, 403 (b)s, most 457 plans and the federal government's thrift savings plan is $23,000 for. The overall 401 (k) limits for.

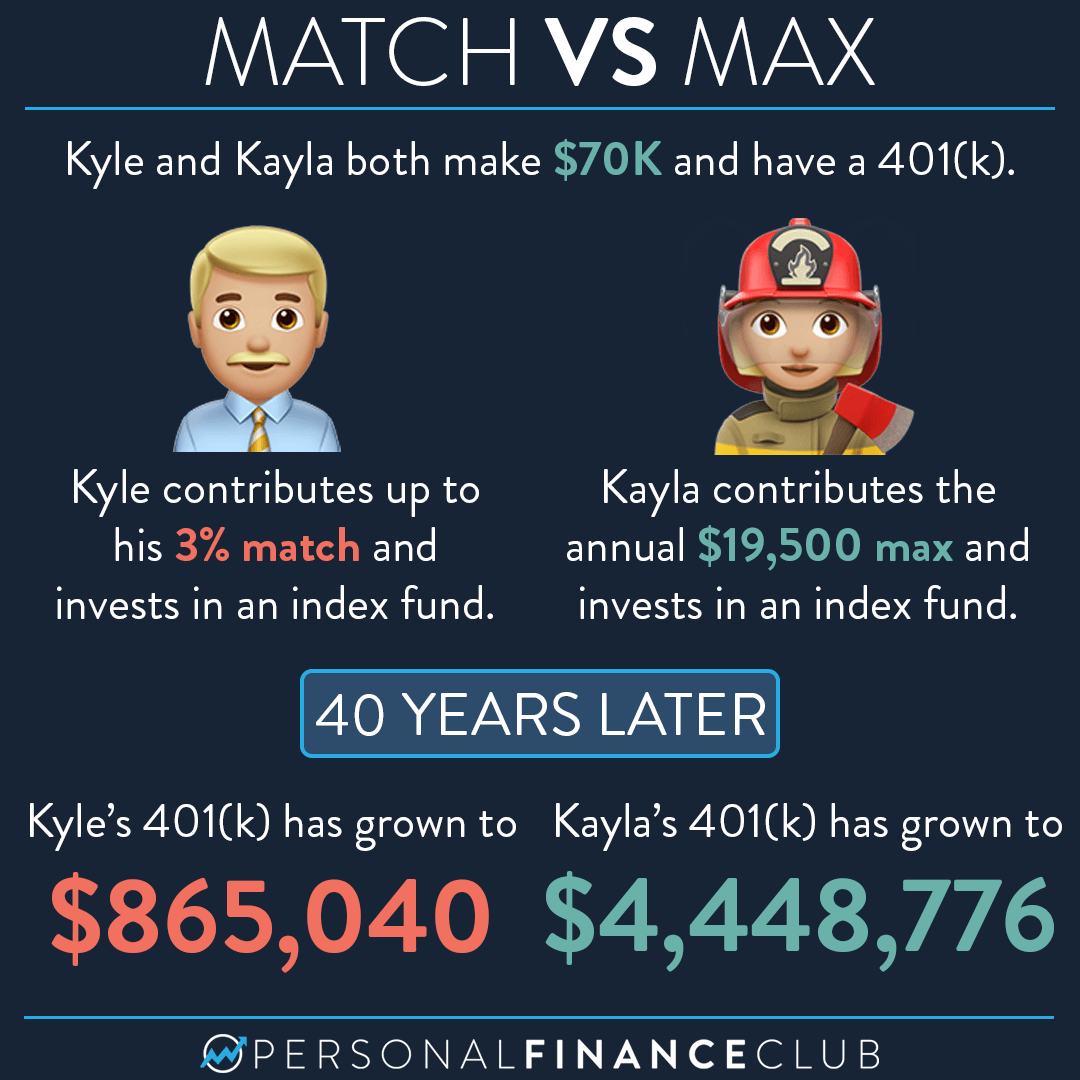

What Is The Max 401k Match For 2025 Ynez Analise, This amount is up modestly from 2023, when the individual. For 2025, the 401 (k) contribution limit for employees is $23,000, or $30,500 if you are age 50 or older.

2025 Max 401k Contribution Limits Catch Up Contributions 2025 Elvina, Here are a few reasons this rmd change to roth 401(k)s could be a big deal: The 401 (k) contribution limit is $23,000 in 2025.

Solo 401k Roth Contribution Limits 2025 Lani Shanta, The 2025 401 (k) contribution limit. The roth 401 (k) contribution limit for 2025 is $23,000 for employee contributions and $69,000 total for both employee and employer contributions.

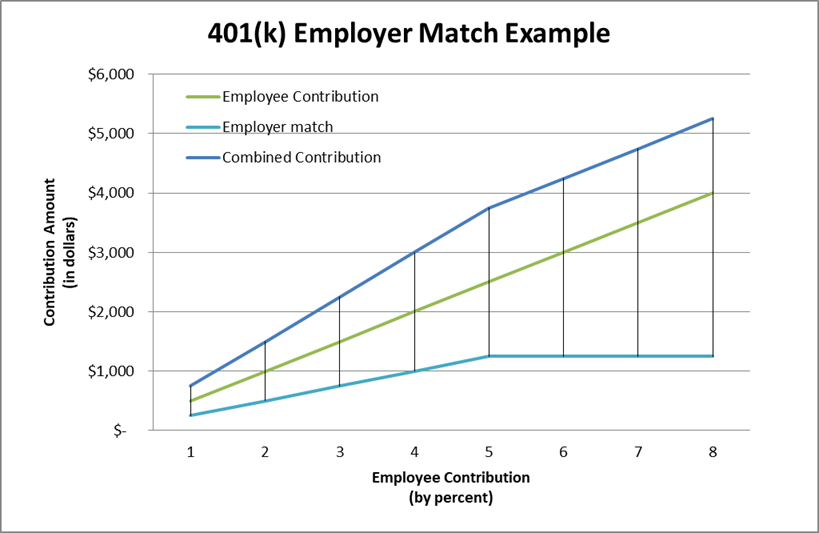

Max 401k Contribution 2025 Including Employer Portal Rhea Velvet, 48 rows every year, the irs sets the maximum 401 (k). This amount is up modestly from 2023, when the individual.

Max 401k Employer Match 2025 Andie Blanche, For 2025, the 401 (k) limit for employee salary deferrals is $23,000, which is above the 2023 401 (k) limit of $22,500. In 2025, the 401(k) contribution limit for participants is increasing to $23,000, up from $22,500 in 2023.

2025 401k Gisele Gabriela, In 2025, the irs allows you to contribute up to $23,000 to your 401(k) plan, up from $22,500 in 2023. This year the irs announced there will be an increase to the maximum employee 401 (k) contribution limit for 2025, increasing it to $23,000, a $500 increase.